Irs Tax Brackets Married Jointly 2025

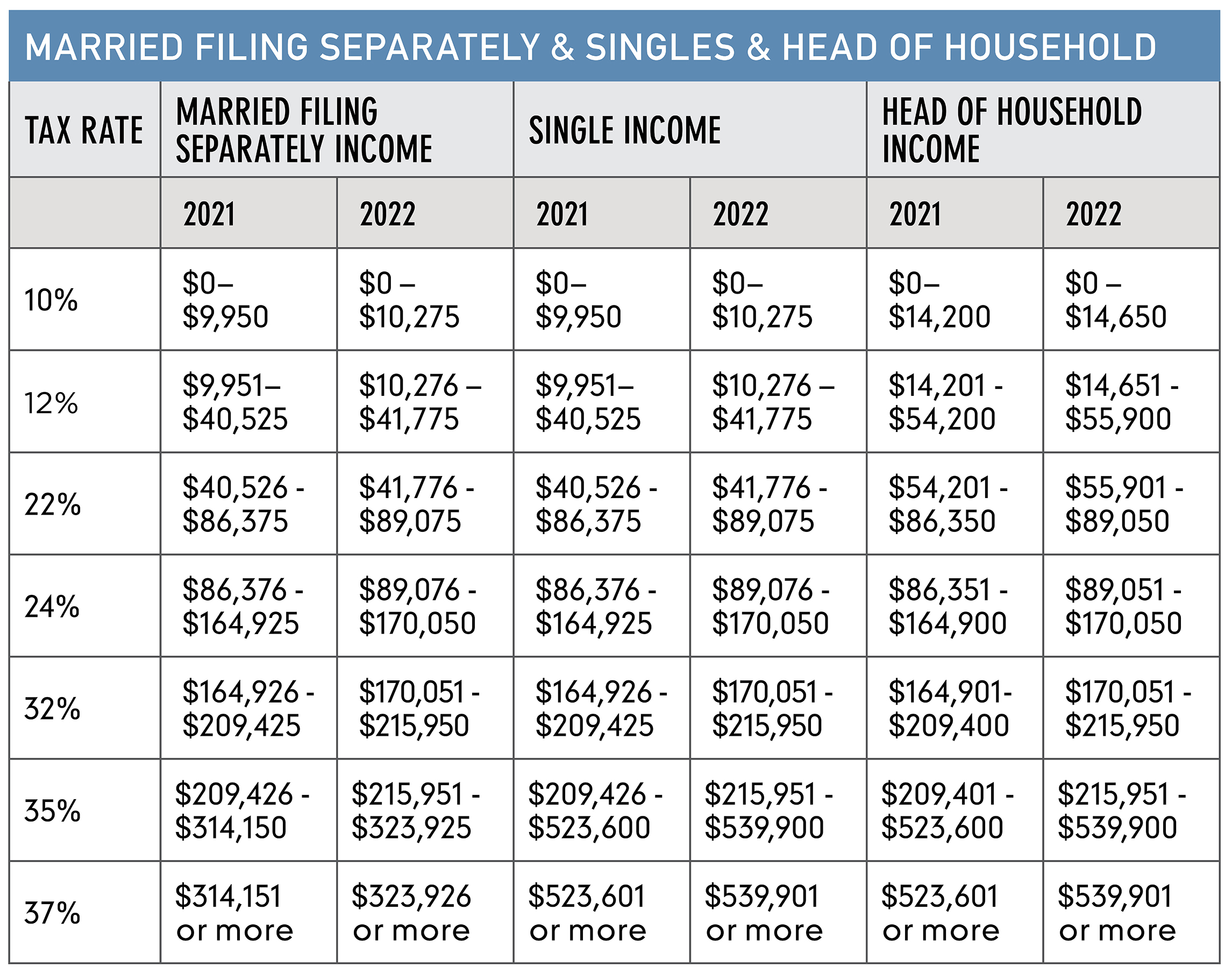

Irs Tax Brackets Married Jointly 2025. Tax rate taxable income (married filing separately) taxable income (head of. The irs released the following tax brackets and income levels for 2025:

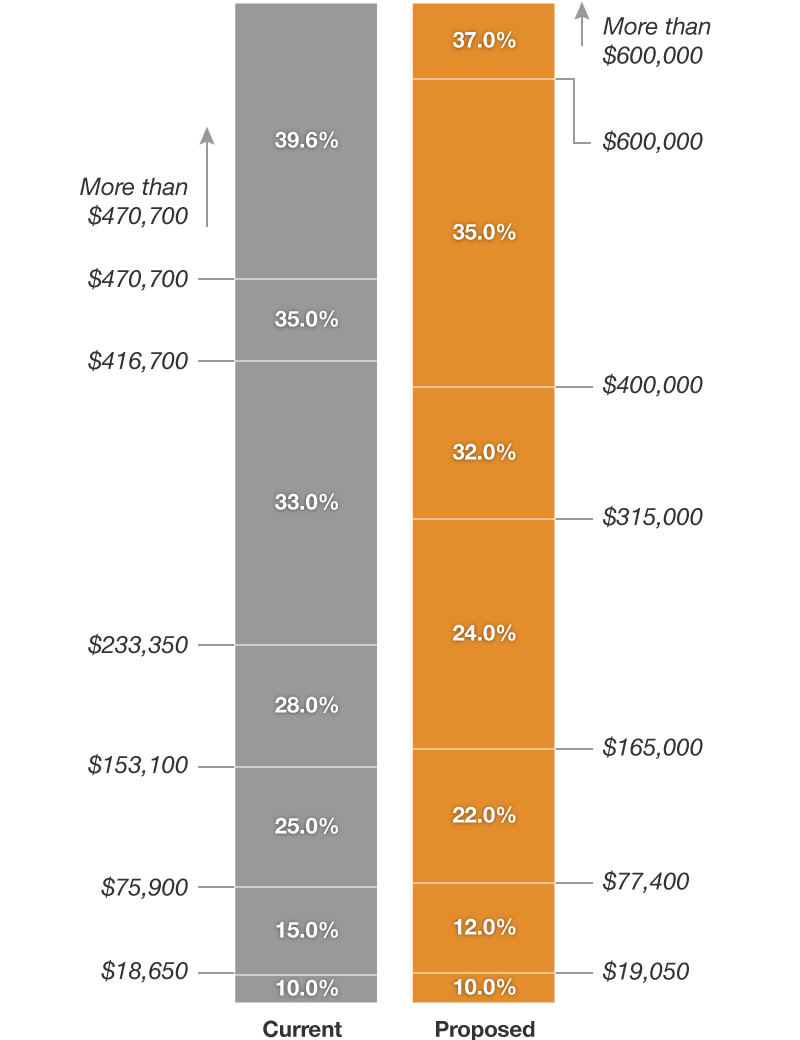

Calculate your personal tax rate based on your adjusted gross income for the 2025 tax year. The federal income tax has seven tax rates in 2025:

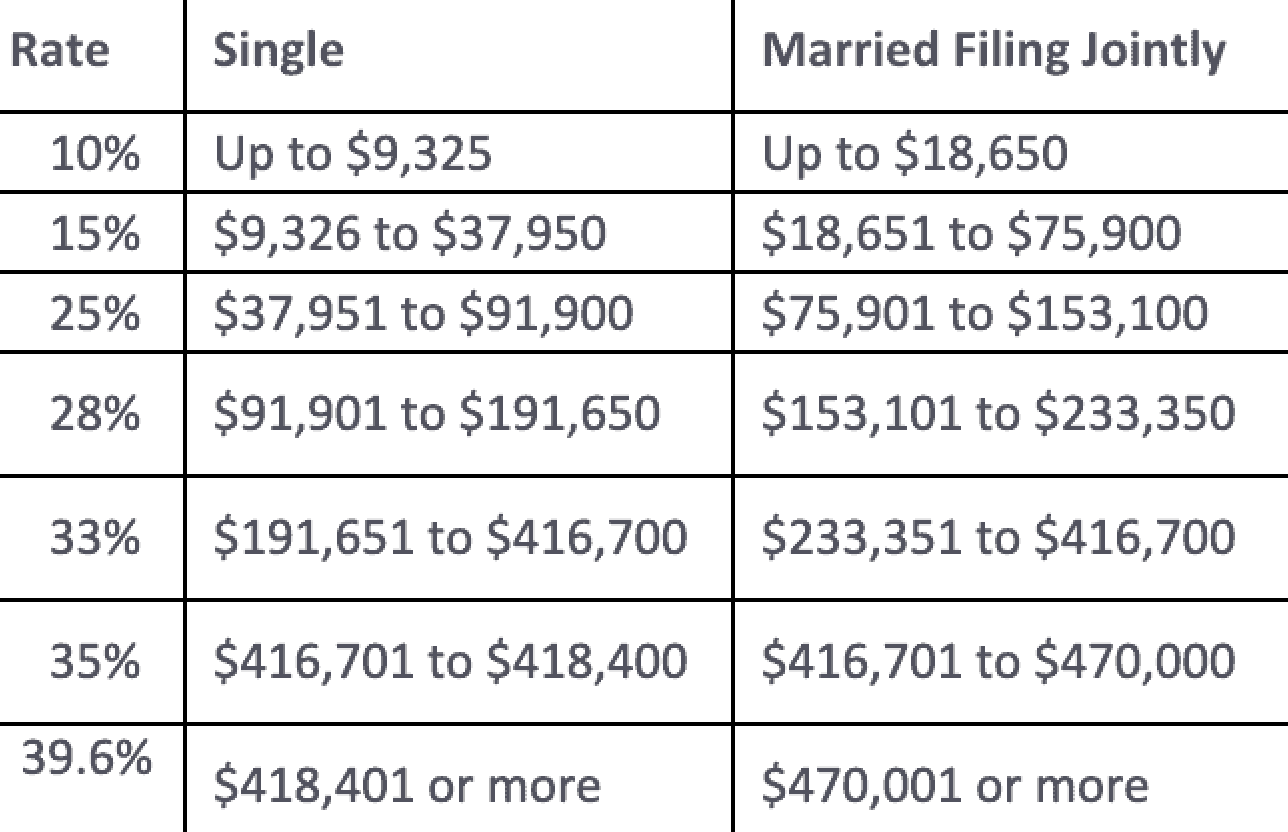

Irs 2025 Tax Brackets Married Jointly April Brietta, The tax agency also released new tax brackets for 2025:

Us Tax Brackets 2025 Married Jointly Liza Maryanne, The irs has announced new tax brackets for the 2025 tax year, for taxes you’ll file in april 2026, or october 2026 if you file an extension.

Tax Brackets 2025 Married Jointly Amil Maddie, The standard deduction will also increase in 2025, rising to $30,000 for married couples filing jointly, up from $29,200 in 2025.

2025 Tax Brackets Married Jointly Calculator Ibbie Melody, Married couples filing separately and head of household filers;

Tax Rates 2025 Married Filing Jointly Frank Morrison, The federal income tax has seven tax rates in 2025:

2025 Us Tax Brackets Married Filing Jointly App Vevay Jennifer, * 35% for incomes over $250,525.

2025 Tax Brackets Head Of Household Married Filing Jointly Dorry Jenilee, Married couples filing separately and head of household filers;

Irs Tax Brackets 2025 Married Filing Jointly Dori Nancie, Your bracket depends on your taxable income and filing status.

Tax Brackets 2025 Married Jointly Married Filing Jointly Liza Maryanne, Starting in 2025, single filers can claim $15,000, a bump.

Tax Brackets For 2025 Tax Year Married Jointly Amie Harmonie, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.